Hidden in every Dimension record is a field called ‘Balance Account’ which has a powerful impact on the way Dimension Tags work. This can be left blank or set to a Ledger Account, and there is one special Ledger Account ‘Control Balance Account’. How does the Balance Account work, and what is the significance of Control Balance Account?

Back in Aug last year I wrote an article explaining that Dimensions have three different purposes

- Analysis dimensions (eg Project)

- Configuration dimensions (eg Payment Type)

- Balance dimensions (eg Sales Invoice Number)

The “Balance Account” field is used with Balance Dimensions such as Invoice Numbers, Customers, Supplier. Lets take an example of a Sales Invoice for £1,000 + £200 VAT:

When a Sales Invoice is raised the postings are as follows:

Sales Invoice Postings |

Db | Cr |

| 1100 Debtors Control Account BS | £1,200 | |

| 2200 Sales Tax Control Account BS | £200 | |

| 4000 Equipment Sales P&L | £1,000 | |

| Dimension tags: | ||

| Sales Invoice Number | £1,200 | |

| Customer | £1,200 | |

| Analysis Dimensions (eg Project) | £1,000 |

The ‘Sales Invoice Number’ Dimension Tag is debited, giving it a balance of £1,200. When the invoice is paid, the ‘Sales Invoice Number’ Dimension Tag is credited leaving a zero balance. It is the zero balance that tells Sage Financials if an invoice has been paid. Similarly the ‘Customer’ Tag is debited when the invoice is raised, so the balance on this Tag shows the total the customer owes.

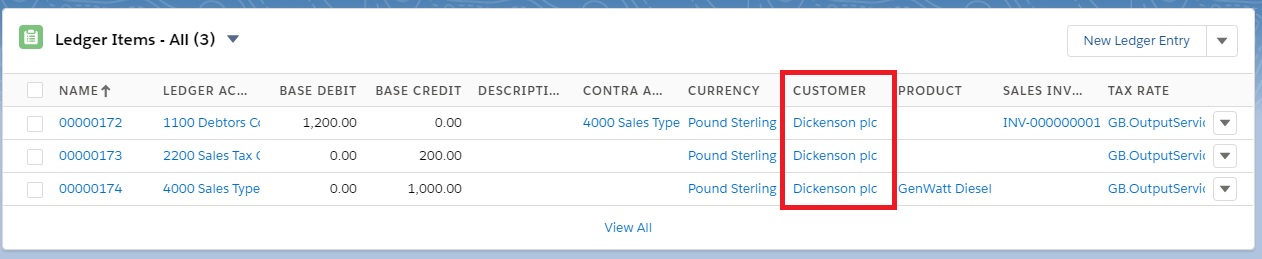

But if you look at the Ledger Items posting for a Sales Invoice you will see the Customer Tag is linked to both the Debit AND the Credit postings:

You would think this would result in a zero net effect. So how does that work?

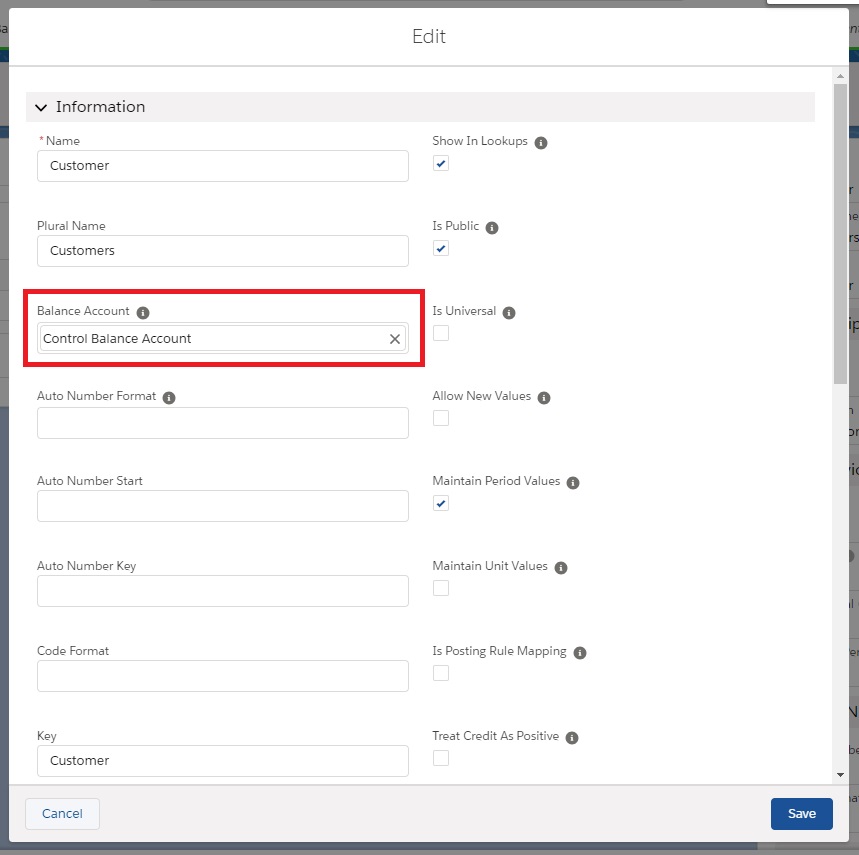

In the Customer Dimension is a field ‘Balance Account’ this used to be visible, but now you can only see it if you [Edit] the Dimension:

If you leave that blank, all postings, Debit & Credit are posted to the Dimension Tag. An example of this is the Project Dimension.

Old Style Balance Account

In earlier versions of Sage Financials the ‘Balance Account’ for the ‘Sales Invoice Number’ and ‘Customer’ Dimensions were set to ‘Debtor Control Account’. This meant only postings to the Ledger Account ‘Debtor Control Account’ were posted to the Tag Balance so in the example above the Customer Tag is Debited £1,200 and the Credits are ignored.

This worked fine for Dimensions like ‘Sales Invoice Number’ or ‘Customer’. When the sales invoice is paid we have the following postings.

Because the ‘Balance Account’ (Debtor Control Account) is credited so the linked ‘Customer’ and ‘Sales Invoice Number’ Tags are also credited, giving a zero balance on the Invoice Number.

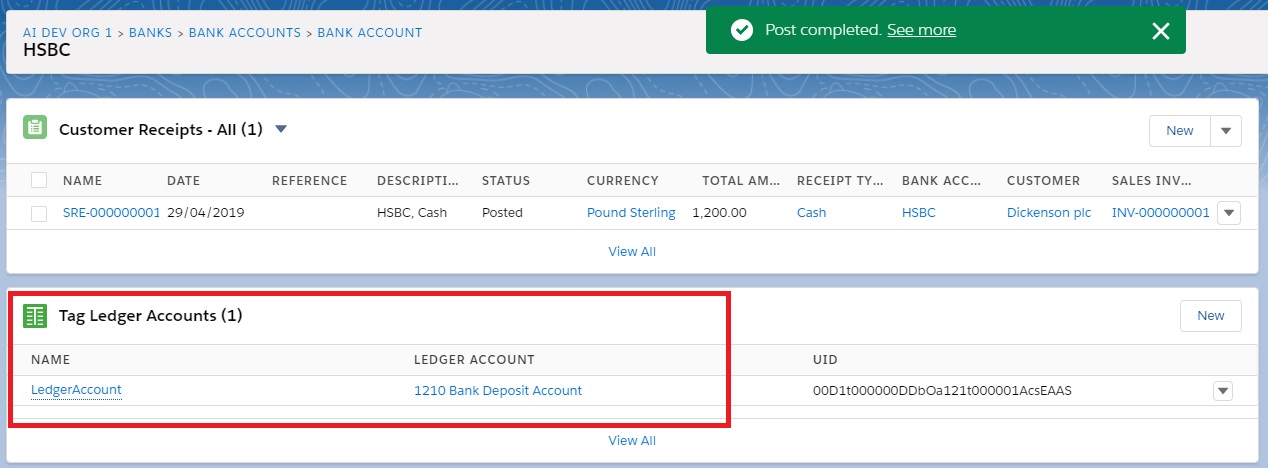

Bank Accounts however are a bit more complicated. In the example above the Ledger Account ‘1200 Bank Current Account’ is debited and this should also debit the ‘HSBC’ Bank Tag. But if you have other bank accounts, for example a USD bank account “HSBC Dollar Account”, you might post to ‘1205 USD Bank Account’ instead of ‘1200 Bank Current Account’. The ‘Balance Account’ is set at the Dimension level, so both “HSBC Dollar Account” and “HSBC Bank” share the same ‘Balance Account’.

The only solution was to leave the ‘Balance Account’ blank, so ALL postings where applied to the Tags. You had to be really careful when using ‘Bank Account’ dimensions in the posting rules or you would mess up the Bank Balances.

New Style Balance Account

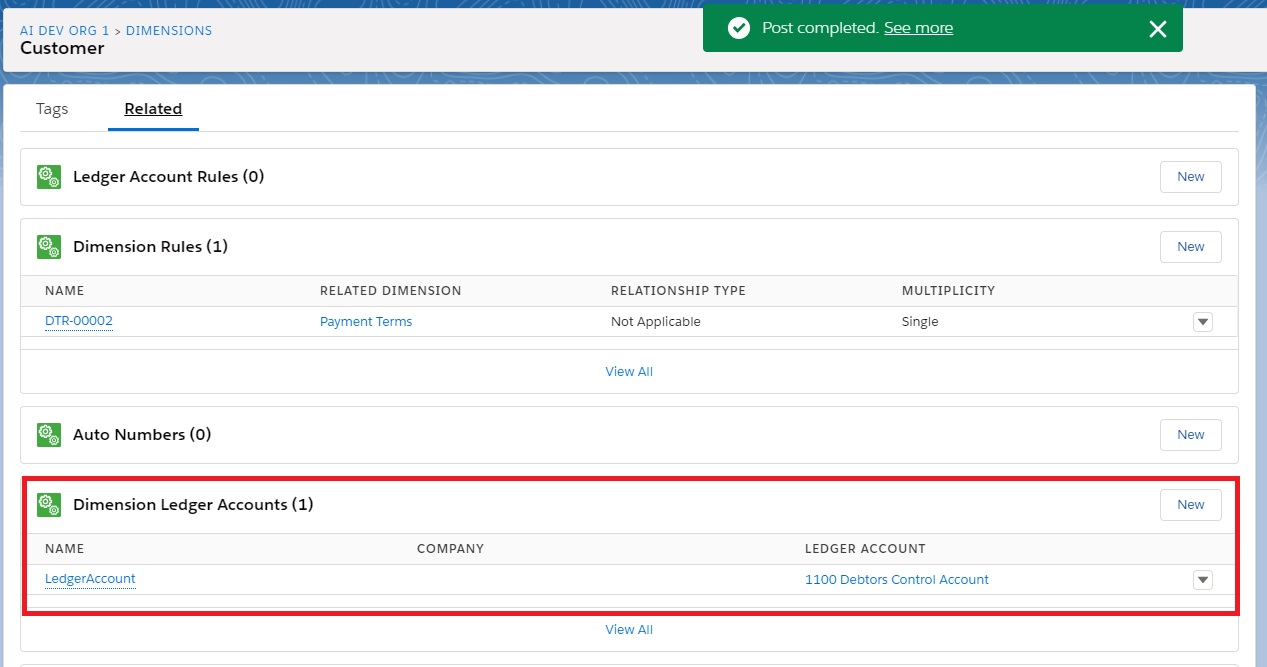

To get around this problem Sage introduced the special Ledger Account ‘Control Balance Account’. How this works is it first looks at the Tag for a Tag Ledger Account of ‘LedgerAccount’ and if that is not setup, it looks the the Dimension for a Dimension Ledger Accounts of ‘LedgerAccount’. When it finds the Ledger Account it applies the same rules as the old style Balance Account.

So if all Tags are treated the same, you can simply configure this at the Dimension level:

But if different tags are associated with different Ledger Accounts you need to set this up at the Tag level:

I hope this article will help you navigate the thrills and spills or posting rule editing!

Did you find this useful? Please register to receive regular updates from Sage Financials knowhow.