The easiest way to enter a Credit Note is to raise it against and invoice. However there are situations when this does not work (see below)

Raise a Credit Note against an invoice

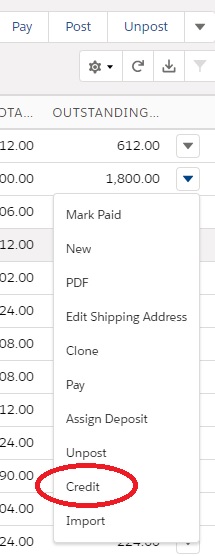

- Navigate to the Invoice and choose ‘Credit’ from the drop-down at the top right.

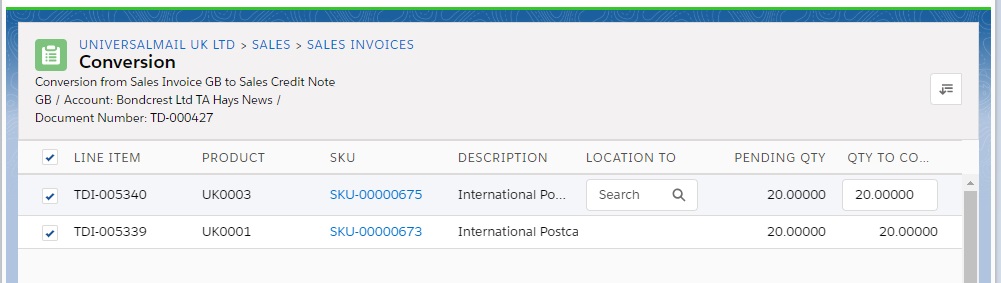

- This then gives you the opportunity to partially credit the invoice by choosing to credit a line items at a time by choosing the quantity to credit.

- Finally, [Post] the credit note

If the Invoice was unpaid, the credit not automatically nets off against the invoice and the transaction is complete. If the Invoice is partially paid, the balance is available for Bank Matching.

Credit note when invoice has been paid

If the invoice has been paid, you use the same process as above, but you will end up with an outstanding balance on the Credit Note.

This can then be netted-off against a future invoice (using ‘Purchases – NET-OFF PURCHASE CN’) or if you choose to pay the Credit Note use ‘Mark Paid’ and Bank Match with TYPE of ‘Supplier Refund’.

Credit note with foreign currency

The simple method of raising a credit note against an invoice does not work unless the exchange rate is exactly the same for both the Credit Note and the matching Invoice.

If the exchange rate has changed you should follow this process:

- Raise a credit note against the invoice as described above but DO NOT post it (or unpost it if you do)

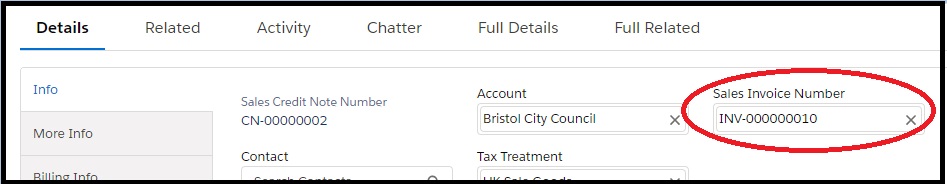

- Edit the Credit Note and remove the Purchase Invoice Number tag

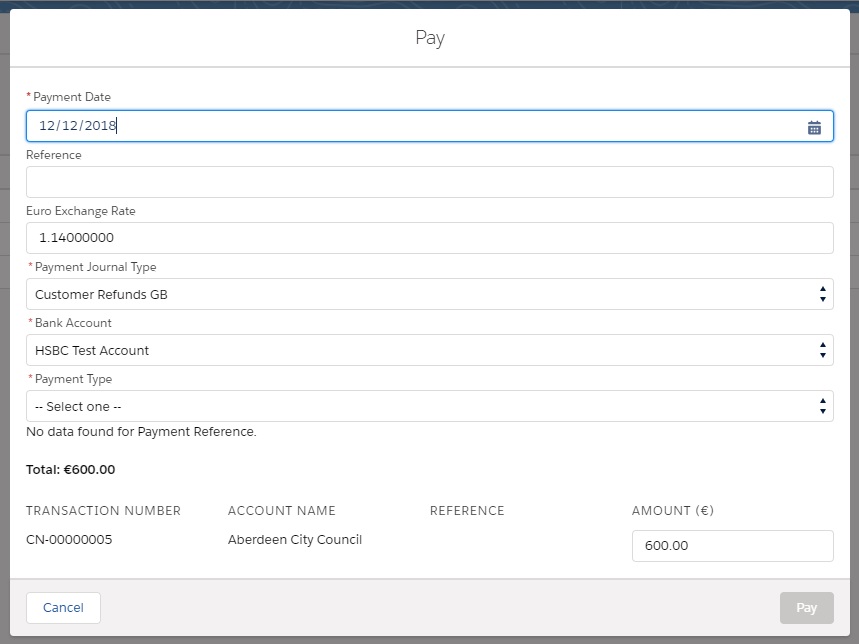

This creates an independent Credit Note, but copies all the details from the Invoice. - When you receive payment use the [Pay] function from the Credit Note to create a ‘Supplier Refund’

The Invoice and Credit note are now both fully paid with the correct currency adjustments. In Bank Matching use ‘Self Match’ to reconcile the bank transaction